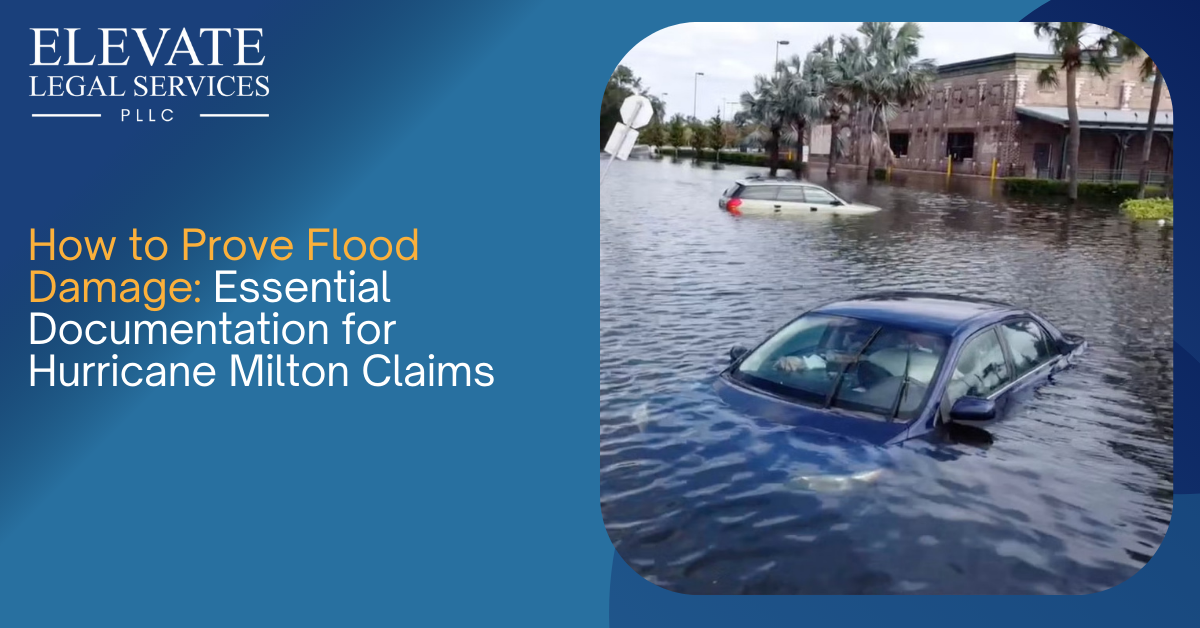

Hurricane Milton left countless homes devastated by rising floodwater, and if you’re a homeowner facing flood damage, filing a thorough and accurate flood insurance claim is critical. Proper documentation can make all the difference in ensuring you receive the compensation you deserve.

At Elevate Legal Services, PLLC, we specialize in fighting for homeowners who have been underpaid or denied by their flood insurance companies. Our experienced legal team is ready to help you navigate this complex process and secure the compensation you’re entitled to. If you are a homeowner facing flood damage insurance claim, contact us today at 561-770-3335 or email us at [email protected] for a free case evaluation.

Here’s a step-by-step guide to proving flood damage effectively and maximizing your claim.

1. Photographic and Video Evidence

Visual documentation is one of the most powerful tools for proving flood damage. Take photos and videos of your property both before and after the storm, if possible. This comparison can clearly show the extent of the damage. After the flood, capture images of every affected area, using wide-angle and close-up shots to highlight key details. Be sure to document:

- Structural Damage: Walls, floors, ceilings, and any cracks in the foundation.

- Water Lines: Capture clear images showing how high floodwater rose.

- Damaged Property: Photograph ruined appliances, electronics, furniture, and other belongings, including serial numbers and product details where possible.

This detailed evidence is crucial in substantiating your claim, helping prevent insurance underpayment or disputes.

2. Document Receipts and Invoices

Every flood-related expense should be meticulously documented with receipts and invoices. This includes costs associated with temporary repairs, cleanup, and evacuation expenses. By documenting these costs, you can demonstrate how much the damage has already cost you and provide a clear estimate for the final repairs.

Key expenses to documents:

- Emergency Repairs: Receipts for any materials or services used to mitigate damage.

- Professional Services: Invoices from specialists such as electricians or plumbers.

- Temporary Housing: Costs for hotel stays or rental properties if you had to vacate your home.

- Replacement Items: Receipts for immediate replacements of damaged furniture, electronics, or other personal items.

By keeping these financial records, you can ensure that you are reimbursed for every out-of-pocket expense caused by the flood.

3. Proof of Ownership

Your insurance company will likely require proof of ownership for high-value items damaged by the flood. For appliances, electronics, and other valuable personal belongings, you’ll need to provide purchase receipts, credit card statements, or warranty information. If these documents are unavailable, you can also use:

- Pre-storm photographs of your property showing valuable items in place.

- Product manuals or warranty registration information that includes serial numbers.

- Bank statements that reflect purchases of high-value items.

Clear proof of ownership helps eliminate disputes over the items included in your insurance claim.

4. Keep a Copy of Your Insurance Policy

Always keep a copy of your flood insurance policy handy, especially the Declarations Page. This page outlines your coverage limits, exclusions, and any special clauses that apply to your claim. Take a photograph or scan the document to keep an electronic copy safe in case the physical document gets lost or damaged in the flood.

5. Proof of Loss Statement

Filing a Proof of Loss (POL) statement is a key requirement for flood insurance claims, especially under the National Flood Insurance Program (NFIP). The POL is a sworn statement detailing the exact amount of damage you’re claiming, supported by all your documentation—photos, receipts, and estimates. The Proof of Loss must be submitted within 60 days of the flood event.

Failure to submit your Proof of Loss on time can result in a denied claim, so it’s essential to file promptly. Working with a public adjuster or attorney from Elevate Legal Services, PLLC can ensure the form is completed accurately and includes all necessary documentation.

6. Get Professional Help

Flood insurance claims, especially those involving the NFIP or private insurers, can be complicated. Hiring a public adjuster or an experienced attorney can help you gather the right documentation, file your Proof of Loss, and negotiate with your insurer. At Elevate Legal Services, PLLC, we specialize in assisting homeowners with flood claims, ensuring that all documentation is thorough and that you get the compensation you deserve.

Why Choose Elevate Legal Services?

At Elevate Legal Services, PLLC, we know how overwhelming the process of filing a flood insurance claim can be after a disaster like Hurricane Milton. Our legal team is dedicated to fighting for homeowners who are struggling with underpaid or denied claims. We work on a contingency basis, meaning you don’t pay unless we recover compensation for you. With our expertise, we’ll ensure that your claim is handled correctly and that every detail is accounted for.

Conclusion

Proving flood damage insurance claim after Hurricane Milton requires careful documentation, from photos and receipts to a timely Proof of Loss statement. If you’re feeling overwhelmed by the process, Elevate Legal Services, PLLC, is here to guide you through every step. With our help, you can ensure that your claim is strong and that you receive the full compensation needed to rebuild.

If you need assistance with your flood damage insurance claim, contact Elevate Legal Services, PLLC today at 561-770-3335 or email [email protected] for a free case evaluation. Our experienced attorneys will help you navigate the complexities of the NFIP and ensure you receive the compensation you’re entitled to. Don’t let the flood damage from Hurricane Milton become a financial burden—let us help you recover and rebuild.